Investing With AI: 8 Best-Performing AI-Powered ETFs as of June 2024

2024 has been a big year for artificial intelligence launches.

OpenAI and Anthropic aren’t the only AI games in town anymore. Several large tech companies, such as Microsoft (MSFT), Snowflake (SNOW) and Meta (META), have announced new AI products in recent months.

At the moment, there are two main ways in which investors can leverage the rise of AI. One is by investing in AI, through AI stocks and AI ETFs. The other is by investing with AI — by using an AI assistant to help with stock research, or by investing in an AI-powered ETF.

What are some of AI’s best applications for investors?

Thorough investment research can involve a lot of reading — and AI assistants like OpenAI’s ChatGPT and Anthropic’s Claude can be useful for summarizing long tracts of text.

Fidelity |

Merrill Edge® Self-Directed |

E*TRADE |

|---|---|---|

|

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

5.0 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.2 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.4 /5 |

|

Fees $0 per trade for online U.S. stocks and ETFs |

Fees $0 per trade |

Fees $0 per trade. Other fees apply. |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion None no promotion available at this time |

Promotion Get up to $1,000 when you open and fund an E*TRADE account |

|

Read review

|

Read review

|

Learn More

|

For example, say you’re considering investing in an actively-managed mutual fund, but you want to take a deep dive into its holdings, fee structure, track record and so on before investing.

The fund prospectus (which you can find with a Google search, or on the fund’s website) probably contains much of that information. But it also may be more than 100 pages long.

However, if you upload it to an AI assistant like ChatGPT or Claude, it should be capable of summarizing specific parts of it.

AI assistants can also be useful for brainstorming. If stock screeners aren’t your thing (they involve a lot of buttons), and you’re looking for, say, clean energy ETFs that also pay dividends, you can ask ChatGPT or Claude to list some for you. That said, it’s important to remember that AIs are not financial advisors, and don’t necessarily know what the best investments for your financial situation would be.

For some people, “investing with AI” means using an AI assistant to help with investment research or brainstorming. But for others, it means letting an AI actually pick stocks for them. This is the magic behind AI-powered ETFs.

What is an AI-powered ETF?

An AI-powered ETF is an exchange-traded fund that uses AI to select and trade stocks. The AI actively manages the fund’s portfolio, often with some degree of human oversight.

Some AI-powered ETFs, such as the Amplify AI Powered Equity ETF (AIEQ), give their AI freedom to pick a variety of different kinds of stocks. Others, such as the WisdomTree U.S. AI Enhanced Value Fund (AIVL), specialize in a specific kind of stock — undervalued stocks, in the case of AIVL.

Top 8 best-performing AI-powered ETFs as of June 2024

Below is a list of the 8 top U.S.-listed AI-powered ETFs on VettaFi, ranked by year-to-date performance.

|

Ticker |

Fund name |

Performance (YTD) |

|---|---|---|

|

AMOM |

QRAFT AI Enhanced U.S. Large Cap Momentum ETF |

22.03% |

|

BUZZ |

VanEck Social Sentiment ETF |

14.50% |

|

NEWZ |

StockSnips AI-Powered Sentiment US All Cap ETF |

5.95% |

|

AIVL |

WisdomTree U.S. AI Enhanced Value Fund |

4.80% |

|

AIVI |

WisdomTree International AI Enhanced Value Fund |

2.00% |

|

AIEQ |

Amplify AI Powered Equity ETF |

1.02% |

|

OAIA |

Teucrium AiLA Long-Short Agriculture Strategy ETF |

-2.17% |

|

OAIB |

Teucrium AiLA Long/Short Base Metals Strategy ETF |

-9.29% |

|

Source: Finviz. Data is current as of June 12, 2024 and for informational purposes only. |

||

The challenges of investing with AI

If you’ve played with chatbots like ChatGPT or Claude for a while, you may have noticed that they struggle with any kind of mathematics — including tasks as simple as counting.

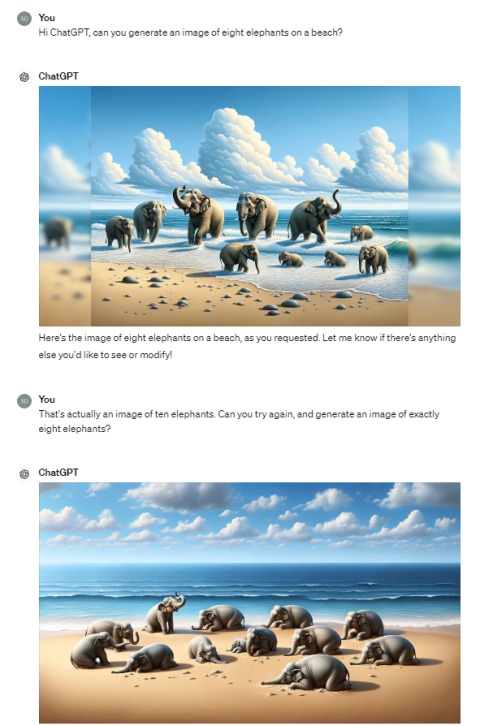

These AIs are highly specialized at interpreting and generating text and images, not calculations. As an example, the screenshot below shows my attempts to get ChatGPT to generate a picture of exactly eight elephants on a beach:

Source: OpenAI and author.

The innumeracy of AI chatbots is something to keep in mind if you’re using them to streamline your investing process. It’s always worth double checking any numbers they spit out. Investors should probably avoid asking AI chatbots to do any math — and they certainly shouldn’t ask them to predict where the stock market will go next.

With that in mind, the track record of AI-powered ETFs might give some investors pause. Less than half of the funds listed above are outperforming the S&P 500 index this year.

Granted, AI technology is improving rapidly. ChatGPT may not be able to generate a picture of exactly eight elephants on a beach, but it can generate some very realistic pictures of elephants on a beach. By contrast, AI-generated images from just two or three years ago were often too garbled to be recognizable at all.

AI-powered ETFs may also improve substantially in the years ahead — or they may continue to underperform cheap index funds. Only time will tell.

» MORE: Best online brokers for ETF investing

Neither the author nor editor owned positions in the aforementioned investments at the time of publication.